Urban Company files draft papers for Rs 1,900-crore IPO

Metafin Secures $10 Million to Accelerate Solar Financing in India

April 28, 2025

Ather Energy’s IPO sees 16% subscription on first day

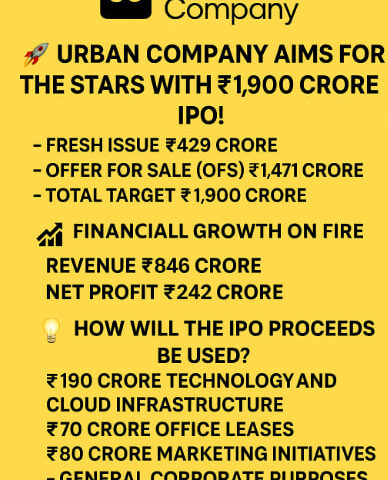

April 28, 2025Urban Company, one of India’s leading home services platforms, is all set to go public with a bang! The company has filed its Draft Red Herring Prospectus (DRHP) with SEBI, preparing to raise ₹1,900 crore through its Initial Public Offering (IPO). This milestone marks a significant leap forward for Urban Company, which has revolutionized the way we experience home services.

💥 Key Highlights of the IPO:

-

Fresh Issue: ₹429 crore

-

Offer for Sale (OFS): ₹1,471 crore from existing investors

-

Total Target: ₹1,900 crore

📊 Financial Growth on Fire!

Urban Company has proven its potential with impressive financial growth. In just the first nine months of FY25, the company clocked ₹846 crore in revenue, a 41% jump from the previous year. Even more exciting, Urban Company achieved profitability, posting a net profit of ₹242 crore — a sharp turnaround from the ₹58 crore loss last year!

💡 How Will the IPO Proceeds Be Used?

Urban Company is focusing on smart investments to boost its future prospects:

-

₹190 crore for enhancing its technology and cloud infrastructure to stay ahead of the curve.

-

₹70 crore for expanding office leases to accommodate the growing team.

-

₹80 crore dedicated to marketing initiatives to further its brand presence.

-

The remainder will be used for general corporate purposes, ensuring continued growth and expansion.

🌟 Star-Studded Investors Backing the IPO

The IPO has drawn strong interest from top investors, including Accel India, Tiger Global, Elevation Capital, and more. The company’s co-founders, Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra, who collectively hold a 20.01% stake, are not selling any shares, showcasing their confidence in the company’s long-term growth.

🏁 A New Era Begins

With renowned financial giants like Kotak Mahindra, Goldman Sachs, and Morgan Stanley handling the IPO, Urban Company is poised for a smooth and successful journey to the stock market. This move is expected to not only fuel its expansion but also strengthen its position as a leader in the home services industry.