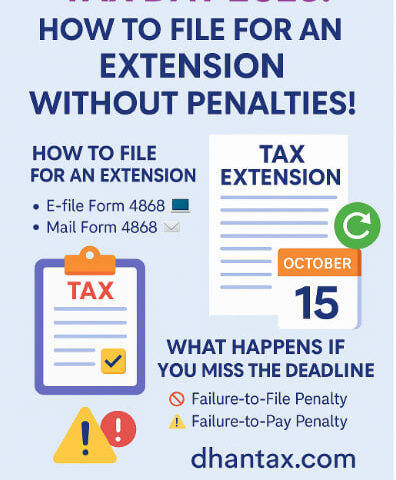

Tax Day 2025: How to File for an Extension Without Penalties!

NFRA Debars 85 Chartered Accountants Till 2025 Over Audit Lapses!

April 18, 2025

Auto Driver from Bhiwani Gets ₹37 Crore Income Tax Notice!

April 18, 2025🧾💡 Tax Day 2025: How to File for an Extension Without Penalties! ⏳📆

As the U.S. 📅 April 15, 2025 deadline looms, many taxpayers are still scrambling to get their documents in order. Don’t stress! 😰💼 The IRS offers an automatic 6-month extension, giving you until October 15, 2025 to file. 🛑 But remember – this extension is only for filing, not for paying your taxes! 💸⚠️

🛠️ How to File a Tax Extension (It’s Easy!)

📌 You can request a filing extension in two ways:

-

💻 E-File Form 4868 via the IRS Free File Tool or tax software

-

✉️ Mail Form 4868 and ensure it’s postmarked by April 15

📣 Pro Tip: Estimate your taxes and pay them before the original deadline to avoid penalties. ✅📤

❌ What Happens If You Miss the Deadline?

If you neither file nor pay on time, here’s what you could face: 😟

🚫 Failure-to-File Penalty: 5% of unpaid tax per month (up to 25%)

🚫 Failure-to-Pay Penalty: 0.5% per month + interest

💬 Even if you can’t pay in full, always file on time and work out a payment plan with the IRS to stay out of trouble! 🛡️

🌍 Dhan Tax Tips for a Smooth Tax Season:

✨ Plan early

📑 Keep digital backups

🧾 Stay updated with IRS notifications

💬 Reach out to experts (that’s us!) for personalized advice

📞 Let Dhan Tax Guide You Through!

Filing late doesn’t mean filing wrong. Let Dhan Tax help you file smart, safe, and stress-free! 🎯🙌

📱 Call Us: +91-7678456921

📧 Email: support@dhantax.com

🌐 Visit: www.dhantax.com