Key Financial Incentives for Startups in Uttar Pradesh

Startup India Scheme in West Bengal – Financial Incentives

February 15, 2025

Key Financial Incentives for Startups in Tripura

February 15, 2025Key Financial Incentives for Startups in Uttar Pradesh

1. Seed Funding Assistance

- Startups can avail seed funding of up to ₹15 lakh to support prototype development, product validation, and operational expenses.

- Priority support for startups in agritech, manufacturing, IT, and healthcare sectors.

2. Lease Rental Reimbursement

- Eligible startups operating from rented premises can receive 50% reimbursement on lease rentals, capped at ₹5 lakh annually, for up to three years.

3. Patent and Trademark Reimbursement

- Patent Filing Fees: Financial support of up to ₹2 lakh for domestic patents and ₹5 lakh for international patents.

- Trademark Registration Fees: Reimbursement of up to ₹1 lakh to secure intellectual property.

4. Marketing and Promotion Assistance

- Startups can claim up to ₹10 lakh annually for participation in national and international trade fairs, expos, and promotional events.

- Additional support of ₹3 lakh annually for branding, advertising, and digital marketing campaigns.

5. Tax Benefits

- Recognized startups are eligible for a three-year income tax holiday, reducing financial burdens during their formative years.

- Stamp Duty and Registration Fee Exemptions for property and land transactions related to startup operations.

6. Capital Investment Subsidy

- Startups can avail 25% reimbursement on fixed capital investments, up to ₹50 lakh, for infrastructure development and machinery purchases.

7. Interest Subsidy on Loans

- Startups are eligible for an interest subsidy of up to 7%, capped at ₹10 lakh annually, for five years.

8. Support for Incubators

- Incubator Setup Grant: One-time grant of ₹1 crore for establishing incubation centers in academic or industrial institutions.

- Performance Grant: Incubators receive ₹5 lakh for every startup they successfully nurture and scale.

9. Special Incentives for Women and Marginalized Entrepreneurs

- Women-led startups and SC/ST entrepreneurs can avail additional financial assistance of ₹5 lakh, promoting inclusivity and diversity.

Why Choose Uttar Pradesh for Startups?

- Strategic Location: Uttar Pradesh’s proximity to major markets and its vast consumer base make it an ideal destination for startups.

- Sectoral Opportunities: Strong focus on agritech, IT, tourism, and renewable energy.

- Supportive Ecosystem: Initiatives like Startup Uttar Pradesh provide mentorship, funding, and incubation facilities.

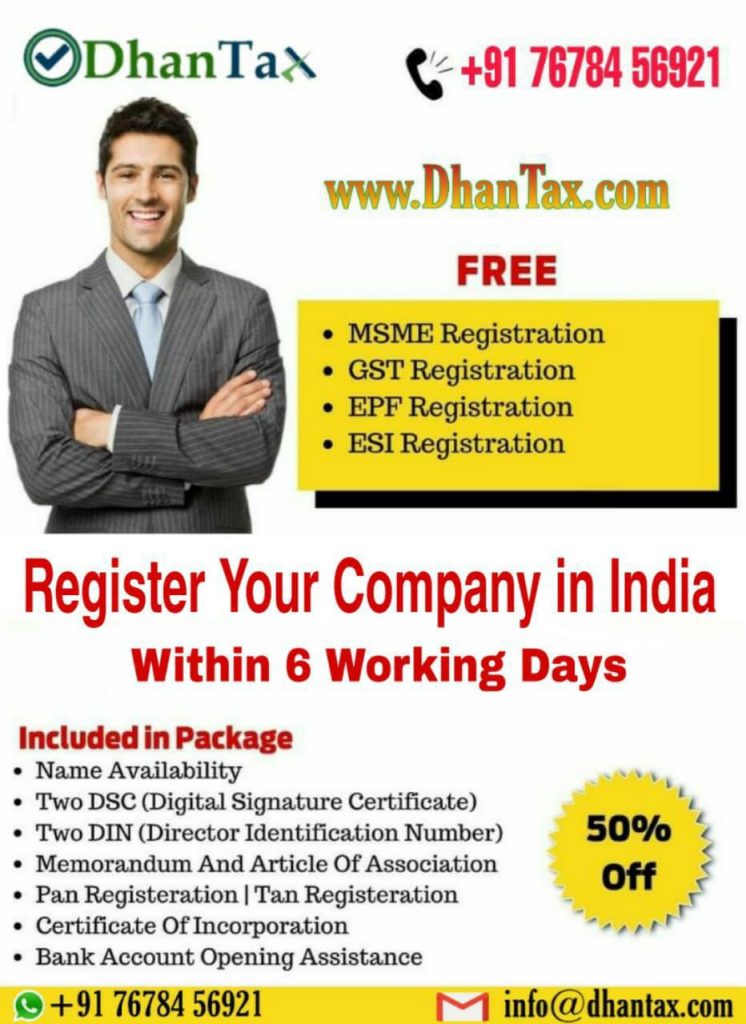

How DhanTax Can Help Your Startup in Uttar Pradesh

DhanTax provides end-to-end consultancy services to help startups in Uttar Pradesh leverage financial incentives, comply with regulations, and achieve growth.

Our Services Include:

- Funding Assistance: Support in applying for seed funding, grants, and subsidies.

- Compliance and Legal Guidance: Simplified processes for registration, tax exemptions, and patent reimbursements.

- Strategic Business Planning: Tailored solutions for market entry and scaling.

- Networking Opportunities: Connections with investors, mentors, and industry experts.

Contact DhanTax

📍 Corporate Office:

A-76 Main Road Chhawla, Near Yashobhoomi International Convention Centre, Dwarka, South West Delhi, New Delhi-110071

📍 Additional Locations:

Delhi | Kolkata | Mumbai | Varanasi | Noida | Vadodara | Uttar Pradesh | Dubai | U.S.A. (Delaware)

📞 Call/WhatsApp: +91 7678456921

📧 Email: support@dhantax.com

🌐 Website: www.dhantax.com

💐 DhanTax – Your Trusted Partner in Startup Growth in Uttar Pradesh! 💐

🚀 Transform Your Startup Vision into Reality with DhanTax Today! 🚀

![]()

Post Views: 23