Income Tax Filing Just Got Smarter: What You Need to Know This Year

💼 Cash Deposit Limit in Savings Accounts: Your 2025 Guide to Staying Tax-Compliant

May 30, 2025

AI Meets Wanderlust: GydeXP Secures Pre-Seed Funding to Revolutionize Experiential Travel

May 31, 2025Income Tax Filing Just Got Smarter: What You Need to Know This Year

It’s that time of year again—Income Tax Return (ITR) filing season is here, and the rules have evolved. Whether you’re a salaried professional, self-employed, or running a business, 2025 brings new disclosures and mandatory details that you can’t afford to overlook.

🧾 The ITR Form Has a New Face

This year, ITR-1 and ITR-4 have been updated to include more transparency-focused questions. These aim to capture a fuller financial picture of the taxpayer, making compliance easier—but only if you’re well-prepared.

🔍 Here’s What’s New in a Nutshell:

1. Foreign Assets? Be Honest.

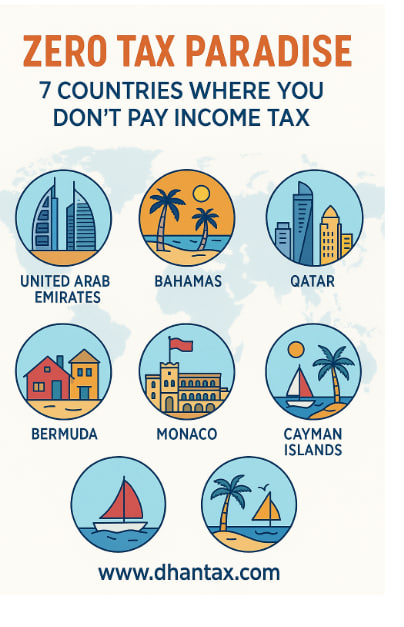

Own shares, properties, or accounts abroad? Now, the form asks for country codes and detailed disclosures on foreign income and assets.

2. Virtual Digital Assets (VDAs): Crystal Clear Reporting Required

If you’ve traded in crypto or other VDAs, the form now demands complete transaction details, including dates, cost of acquisition, sale consideration, and taxes paid.

3. Agriculture Income Isn’t Off the Grid Anymore

Even if it’s exempt, agricultural income over ₹5 lakh needs supporting documents like land details, ownership proof, and even the number of cropping seasons.

4. Interest from Savings & Deposits: Segregation is a Must

Instead of clubbing all interest income, you now have to separate savings interest, fixed deposit interest, and other types under distinct heads.

5. Enhanced Capital Gains Reporting

Capital gains? You’ll need to fill in ISIN details, purchase and sale dates, and scrip-wise reporting. For those with market-linked instruments, this means extra diligence.

🚨 Ignorance Isn’t an Excuse Anymore

Many taxpayers delay or overlook disclosures, risking notices, scrutiny, or penalty. The income tax department is integrating more data from PAN-Aadhaar, banks, mutual funds, crypto exchanges, and foreign portals than ever before.

If your income structure is simple, you can still file smoothly. But for most others, filing without expert help is like walking a tightrope without a safety net.

🛡️ How DhanTax Helps You Stay Ahead

At DhanTax, we’re not just filing your return—we’re shielding you from future tax troubles. Our updated tools and team are equipped to:

-

Map your income from all sources (salary, business, capital gains, foreign income, and digital assets)

-

Validate and match your AIS/TIS data with your real-time statements

-

Help you navigate crypto tax rules, foreign asset declarations, and agricultural income reporting with precision

-

Ensure zero-error filing with smart form validations and checks

🎯 Final Word: Smart Filing is Strategic Filing

This year, don’t just aim to “submit” your return. Let DhanTax help you file it right, on time, and with full confidence. The income tax department is getting smarter—make sure your filing is smarter too.

Because in 2025, it’s not just about paying taxes—it’s about how well you file.

Let me know if you’d like to add a CTA (Call-to-Action) at the end, like a contact form, WhatsApp number, or scheduling link for tax filing assistance.