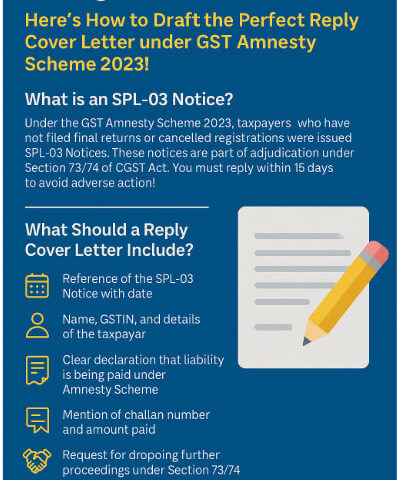

Facing GST SPL-03 Notice? Here’s How to Draft the Perfect Reply Cover Letter under GST Amnesty Scheme 2023!

Demystifying Net Owned Funds (NOF) Under the RBI Act, 1934

April 19, 2025

Resolving Foreign Investment Disputes in India: Key Remedies & Protections Explained!

April 19, 2025📩 Facing GST SPL-03 Notice? Here’s How to Draft the Perfect Reply Cover Letter under GST Amnesty Scheme 2023! 🧾

✅ Issued SPL-03 Notice under GST Amnesty Scheme?

Don’t panic! The GST Amnesty Scheme 2023 is your golden chance to settle long-pending dues and avoid harsh penalties. But responding correctly is crucial — and it all begins with a well-drafted cover letter to the jurisdictional officer.

📌 What is an SPL-03 Notice?

Under the special amnesty drive initiated by the CBIC, taxpayers who have not filed final returns (GSTR-10) or cancelled registrations were served SPL-03 Notices. These are part of the adjudication process under Section 73/74 of CGST Act. You must reply within 15 days to avoid adverse action!

✍️ What Should a Reply Cover Letter Include?

A proper Reply Cover Letter should reflect:

-

📅 Reference of the SPL-03 Notice with date

-

🧑💼 Name, GSTIN, and details of the taxpayer

-

📄 Clear declaration that liability is being paid under the Amnesty Scheme

-

📝 Mention of challan number and amount paid

-

🙏 Request for dropping further proceedings under Section 73/74

📝 Sample Format Highlights

Here’s what you can mention in your cover letter:

Subject: Reply to Notice in Form GST DRC-01 for Assessment under Section 73/74 – Request for Closure under GST Amnesty Scheme

Respected Sir/Madam,

With due respect, I/We wish to submit that the tax dues as per the above-referenced notice have been fully discharged through payment under the GST Amnesty Scheme vide challan No. XXXXXXX dated DD/MM/YYYY…

In view of the same, we kindly request your good office to drop the proceedings initiated under Section 73/74…

➡️ Keep it simple, professional, and respectful.

⚖️ Why This Letter Matters?

📍 This one-page reply shows your intent to comply with the law.

📍 It becomes part of your defense if any future dispute arises.

📍 Without this, your GST cancellation case may remain pending.

💡 Dhan Tax Expert Tip:

🕐 Don’t delay!

If you’ve received a GST SPL-03 notice — reply within the 15-day window. Need help? Let our experts handle the drafting and submission for you with 100% accuracy ✅

📞 Call Us: +91 7678456921

📧 Email: info@dhantax.com

🌐 Visit: www.dhantax.com