Demystifying Net Owned Funds (NOF) Under the RBI Act, 1934

etSynthesys Secures Strategic Investment from Global Gaming Leader KRAFTON – Accelerating India’s Digital Entertainment Revolution!

April 19, 2025

Facing GST SPL-03 Notice? Here’s How to Draft the Perfect Reply Cover Letter under GST Amnesty Scheme 2023!

April 19, 2025💼 Demystifying Net Owned Funds (NOF) Under the RBI Act, 1934 📊

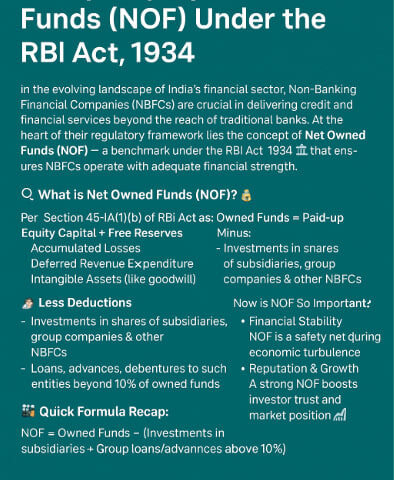

In the evolving landscape of India’s financial sector, Non-Banking Financial Companies (NBFCs) are crucial in delivering credit and financial services beyond the reach of traditional banks. 💳 At the heart of their regulatory framework lies the concept of Net Owned Funds (NOF) — a benchmark under the RBI Act, 1934 🏛️ that ensures NBFCs operate with adequate financial strength.

🔍 What is Net Owned Funds (NOF)? 💰

As per Section 45-IA(1)(b) of the RBI Act, 1934, NOF is calculated as:

1️⃣ Owned Funds = Paid-up Equity Capital + Free Reserves

❌ Minus:

-

Accumulated Losses

-

Deferred Revenue Expenditure

-

Intangible Assets (like goodwill)

2️⃣ Less Deductions:

-

Investments in shares of subsidiaries, group companies & other NBFCs

-

Loans, advances, debentures to such entities beyond 10% of owned funds

📌 This formula ensures NBFCs maintain true capital strength, not inflated by inter-group dealings.

🧠 Why Is NOF So Important?

✅ Regulatory Compliance – Essential to get or keep the Certificate of Registration (CoR) from RBI

✅ Financial Stability – NOF is a safety net during economic turbulence

✅ Reputation & Growth – A strong NOF boosts investor trust and market position 📈

📆 Timeline of NOF Requirement Changes

📍 Earlier Requirement: ₹25 Lakh

📍 Now: Many NBFCs must maintain ₹10 Crore minimum NOF, as per recent RBI circulars 🏦

This evolution reflects the RBI’s intent to strengthen the financial backbone of the NBFC ecosystem 💪

🔐 Final Thought

💡 Net Owned Funds are not just numbers; they represent the financial soul of an NBFC.

RBI’s emphasis on NOF helps ensure the sector remains credible, sustainable, and investor-friendly. Whether you’re running an NBFC or planning to register one, understanding NOF is your first step towards long-term compliance and success. 🛤️

📞 Contact Dhan tax for NBFC Advisory & Compliance Support

📱 Mobile: +91 76784 56921

📧 Email: info@dhantax.com

🌐 Website: www.dhantax.com