🧾 ITR-1 & ITR-4 Now Live for AY 2025-26

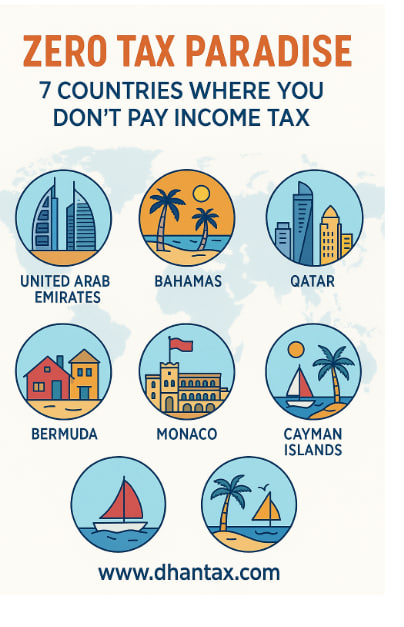

Zero Tax Paradise: 7 Countries Where You Don’t Pay Income Tax

May 31, 2025

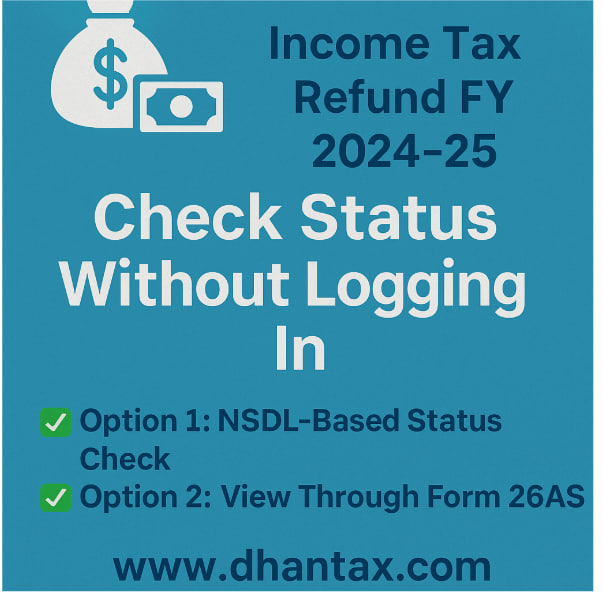

💸 Income Tax Refund FY 2024-25: Check Status Without Logging In

June 6, 2025ITR-1 & ITR-4 Now Live for AY 2025-26

🚀 Time to File Smart with Dhantax!

Filing season has officially begun! The Income Tax Department has activated the online filing facility for ITR-1 (Sahaj) and ITR-4 (Sugam) for Assessment Year 2025-26. If you’re a salaried employee, pensioner, or running a small business or profession — this is your moment to act.

✅ Who Should File ITR-1?

ITR-1 is meant for resident individuals with:

-

Income up to ₹50 lakh

-

Income from salary or pension

-

Income from one house property

-

Income from other sources (like interest income)

-

Agricultural income up to ₹5,000

✅ Who Should File ITR-4?

ITR-4 applies to individuals, HUFs, and firms (other than LLPs) who:

-

Have total income up to ₹50 lakh

-

Have income from business/profession under presumptive taxation (Sections 44AD, 44ADA, or 44AE)

🆕 What’s New in AY 2025-26?

-

Capital Gains of ₹1.25 Lakh Now Allowed: Taxpayers with LTCG up to ₹1.25 lakh from listed equity shares or equity mutual funds can now file ITR-1 or ITR-4 — provided they don’t have capital losses to carry forward.

-

Mandatory Disclosure of TDS Section: Taxpayers must now mention under which section TDS has been deducted — ensuring transparency and accuracy.

-

Enhanced Capital Gains Reporting: Special disclosure required for capital gains on assets sold on or after 23rd July 2024.

💡 Why File Early?

-

Skip the last-minute rush

-

Get faster refunds

-

Fix errors or mismatches in advance

-

Focus on tax planning, not deadline panic

🧠 Dhantax Makes It Easy!

Whether you’re new to filing or a seasoned taxpayer, Dhantax ensures:

-

Guidance on selecting the correct form

-

Error-free, expert-assisted filing

-

Personalized support to match your tax profile

-

Faster processing & peace of mind

🎯 Let Dhantax Be Your Tax Partner

This tax season, don’t just file your return — file it smart, file it early, and file it right with Dhantax. Let us help you turn complexity into clarity.

Your numbers, our responsibility.

Get started with Dhantax today.