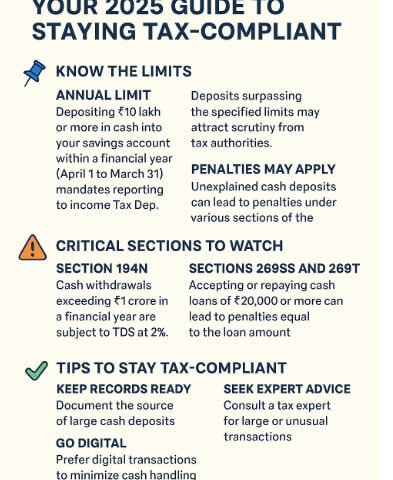

💼 Cash Deposit Limit in Savings Accounts: Your 2025 Guide to Staying Tax-Compliant

💰 Cash Deposit Limit in Savings Accounts: A 2025 Guide for Smart Tax Compliance

May 30, 2025

Income Tax Filing Just Got Smarter: What You Need to Know This Year

May 31, 2025Cash Deposit Limit in Savings Accounts: Your 2025 Guide to Staying Tax-Compliant

As we step deeper into a data-driven financial world, cash transactions are under sharper scrutiny than ever before. One critical area where taxpayers often get caught unaware is the cash deposit limit in savings accounts. Whether you’re an individual saver or a small business owner, understanding these rules is vital to avoid unnecessary trouble with the tax authorities.

📌 Know the Limits

-

Annual Limit

If you deposit ₹10 lakh or more in cash into your savings account within a financial year (April 1 to March 31), your transaction will be reported to the Income Tax Department. Multiple small deposits adding up to this amount can also trigger alerts. -

Daily Limit

Depositing ₹50,000 or more in a single day into your account? You must furnish your PAN. Failing to do so could halt the deposit or invite future inquiries.

⚠️ Exceeding Limits Can Be Costly

-

Tax Scrutiny

High-value cash transactions often trigger red flags. The income tax department may question the source and legitimacy of such funds. Be ready with documentation. -

Penalties May Apply

Unexplained cash deposits may attract a penalty up to 100% of the amount, depending on the section of the Income Tax Act that is invoked.

🧾 Critical Sections to Watch

-

Section 194N

Withdraw more than ₹1 crore in a year, and TDS at 2% will be deducted. For individuals not filing income tax returns for the past three years, the limit drops and the TDS rate increases. -

Section 269ST

Receiving ₹2 lakh or more in cash from a person in a single day—whether for services, gifts, or loans—is prohibited. It can result in severe penalties. -

Sections 269SS & 269T

Accepting or repaying loans of ₹20,000 or more in cash is banned. Violating this can lead to a penalty equal to the loan amount.

✅ Tips to Stay Tax-Compliant

-

Keep Records Ready

Document all large cash transactions. Bills, agreements, and declarations help you stay on the right side of the law. -

Go Digital

Make use of online banking and digital wallets. Not only do they reduce the risk of tax scrutiny, but they also offer clear trails for all transactions. -

Seek Expert Advice

If you’re unsure about a transaction, consult a tax expert. Prevention is always better than penalty.

📣 Final Word from DhanTax

In 2025, financial transparency isn’t just a best practice—it’s a necessity. At DhanTax, we help individuals and businesses navigate complex tax landscapes with clarity and confidence. Stay smart. Stay compliant. Let DhanTax be your guide.