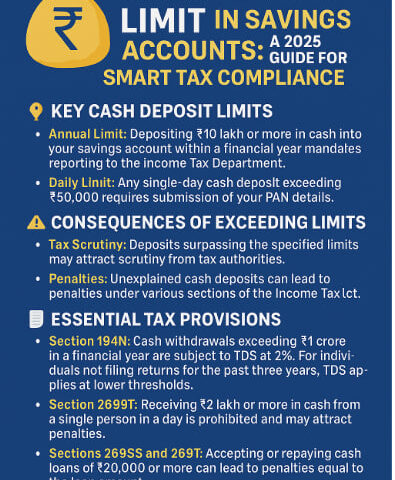

💰 Cash Deposit Limit in Savings Accounts: A 2025 Guide for Smart Tax Compliance

In today’s rapidly evolving financial environment, being aware of your rights and responsibilities as a taxpayer isn’t just smart—it’s essential. One of the most critical yet often overlooked aspects of personal finance is the cash deposit limit in your savings account. With increasing digitization and surveillance in the banking ecosystem, understanding these limits can protect you from unwanted scrutiny and penalties.

Let’s break it down for you.

📌 What Are the Key Cash Deposit Limits?

-

Annual Cash Deposit Limit

If you deposit ₹10 lakh or more in cash in your savings account in a single financial year (April 1 – March 31), this transaction will be reported to the Income Tax Department. Such high-value deposits trigger alerts and may invite a review. -

Daily Cash Deposit Limit

Planning to deposit ₹50,000 or more in a single day? You’ll need to provide your PAN details to proceed. This ensures your transactions remain within the visible financial network.

⚠️ What Happens If You Cross the Limits?

-

You May Face Tax Scrutiny

Surpassing the specified cash limits doesn’t just end with a receipt. It can invite inquiries, and in some cases, even income tax notices asking you to explain the source of funds. -

You Risk Penalties

Unexplained or unjustified cash deposits can attract penalties under the Income Tax Act, and in severe cases, the deposit amount may be added to your taxable income with fines imposed.

🧾 Important Tax Provisions You Must Know

-

Section 194N

If you withdraw over ₹1 crore in cash in a financial year, a TDS of 2% is applicable. For non-filers of tax returns, this threshold drops, and higher TDS rates may apply even for smaller withdrawals. -

Section 269ST

Receiving ₹2 lakh or more in cash from any person in a single day is strictly prohibited. This includes payments for services, gifts, or personal loans and may attract a penalty equal to the amount received. -

Sections 269SS and 269T

Cash loans or repayments of ₹20,000 or more are also under strict observation. Violating this rule can result in a 100% penalty of the transaction amount.

✅ Smart Tips to Stay Compliant

-

Maintain Transaction Records

Always keep clear documentation and justification for large cash deposits. Be it salary, business income, or gift—proof matters. -

Go Digital When Possible

Use online transfers, UPI, NEFT, or other digital modes for high-value transactions. They’re safer, faster, and tax-compliant. -

Consult a Tax Expert

Large or frequent deposits? A quick consultation with a tax professional can help you avoid long-term issues and save you money.

🔍 Final Thoughts

Cash transactions aren’t illegal, but unchecked deposits can put your financial credibility at risk. In the age of data-driven tax governance, proactive compliance is your strongest shield. As we navigate 2025, let’s make every deposit count—for growth, not for trouble.

Stay smart. Stay compliant. Stay with DhanTax—your partner in tax clarity.

Would you like the same content in a downloadable PDF or formatted for WordPress publishing?